Total Revenue Foregone: INR 1, 45,000 cr. per year.

All these announcements will be applicable from 01.04.2019 (Current FY) any advance tax paid will be adjusted.

Income tax act has been amended to promote growth & investment wef F.Y. 2019-20 which allows any domestic co. to pay income tax @ 22%

Condition: They will not avail any exemption or incentives

Effective tax rate is 25.17% {incl. of all surcharges}

Minimum Alternate Tax {MAT} Not applicable

To attract fresh investment and boost to make in India another provision is added to Income Tax act: New co. incorporated on or after 01/10/2019 getting fresh investment in manufacturing pay income tax @15%.

Condition: They will not avail any exemption or incentives

Effective tax rate 17.01% {incl. of all surcharges}.

Minimum Alternate Tax {MAT} Not applicable

A co. which doesn’t opt for concessional tax regime and avails tax exemption shall continue to pay at pre amended rate.

However, these co. can opt for concessional tax regime after expiry of tax period.

Related Blog – All you need to know about Company Registration as a startup

Minimum Alternate Tax (MAT): Reduced from existing 18.5% to 15%.

Stabilise flow of funds in capital market: Enhanced surcharges introduced in finance act (II) 2019 shall not apply on capital gains arising on sale of equity share in a co./business/trust liable for Securities Transaction Tax {STT}.

Expand scope of CSR: 2% spending can be spent on incubators funded by centre/state government/PSU/contribution to IIT, National labs, all under ICAR, DRDO etc. engaged in research science/research comes under CSR

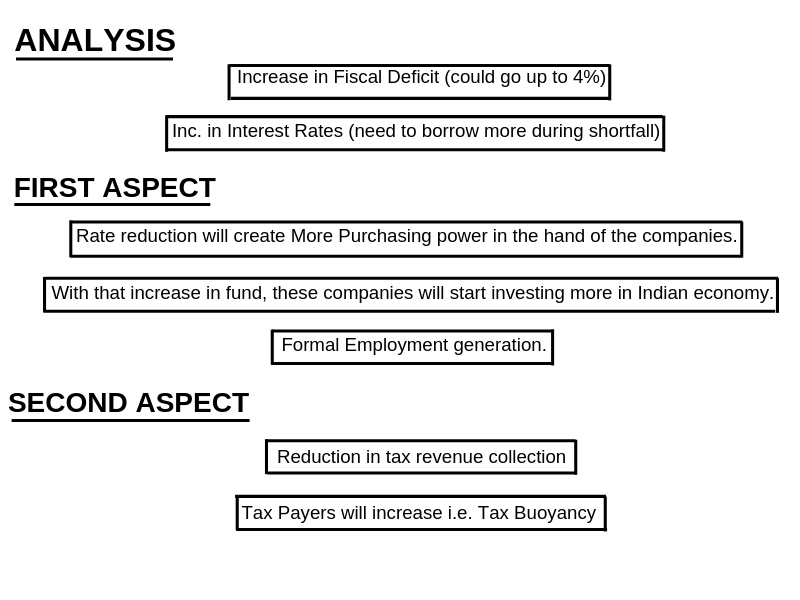

ANALYSIS

Current corporate tax rate is 30% (incl. surcharge/cess 34%) brought down to 22% (incl. surcharge/cess 25.17%) i.e. around 9 basis point effective relief in tax for current corporations.

New manufacturing: 25% (incl. surcharge/cess 29.12%) brought to 15% (incl. surcharge/cess 17.01%) 12 basis point effective relief in tax for new manufacturers. This will certainly give a boost to new manufacturers to establish their manufacturing units in India and achieve the goal of “Make in India” a reality.

Q. What impact this decision would have on the corporate sector?

- Promote “Make in India”

- Making India an Investment hub

- Boost Indian economy

- Employment generation

- More Transparent structure

- Wealth creation

- Export led manufacturing

- Multiplier affect

- Long term transition period

- Companies cash flows will improve

Q. How to get the complete benefit of this corporate tax restructuring?

If you have an existing company or you want to establish a new company, we provide “One Stop Solution” to all your problems.

To grab this opportunity and bring the benefits of this tax restructuring in your business, feel free to reach out. Get your Company Registration in a hassle free way with our financial expert in your area who will guide you in all your finance related matters.