A Private Limited Company is the best and highly recommended business structure to start a business in India. Online company registration in Delhi is easy to form and operate therefore being the most acceptable form of business. Let’s have a look at the benefits of Company Incorporation:

- Provides limited liability to its shareholders

- The directors may be different form the shareholders i.e. owners

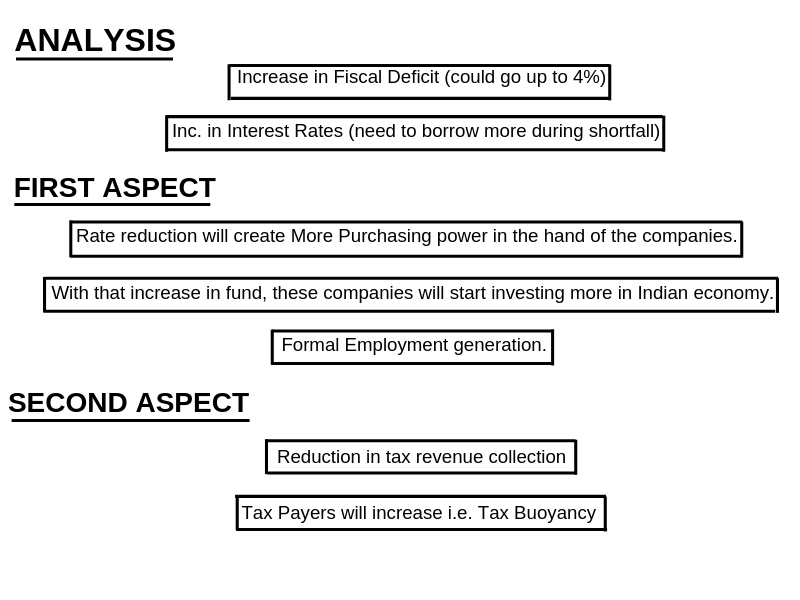

- Tax benefits

- Ease of getting bank loans

- Legal Recognition

- Perpetual succession

- Preferred by investors

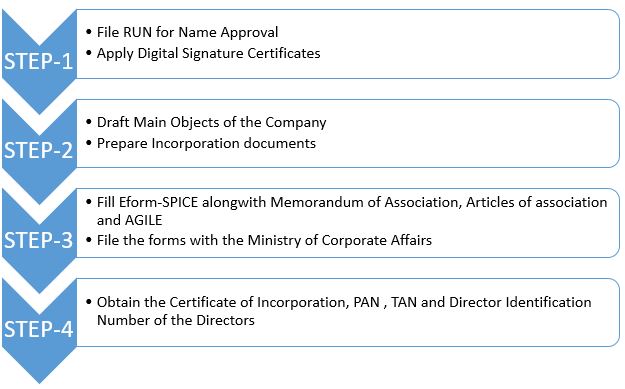

The private limited companies incorporated are governed by the Ministry of Corporate Affairs and to speed-up the incorporation the registration application is processed by the Central Registration Center. The steps for Private Limited Company registration in Delhi is as follows:

Important Points to be kept in mind while doing Online Company Registration In Delhi:

- ONE PERSON COMPANY: One person company registration in Delhi, An OPC as the name suggests is a combination of benefits derived from sole proprietorship and Company form of business, it is suitable for those who want complete control over the ownership, management and operations of the company. At the initial stage one needs to decide whether they will go for a One Person Company or private limited with 2 directors and shareholders.

Related Blog – All you need to know about Company Registration as a startup

- UNIQUE NAME: Once decided on the form of private limited company the next step is to find a unique name for the proposed Company. The name of the proposed company should not be similar with any existing company name. So a thorough check of MCA database and trademarks in the related class needs to be done before applying the name with the ministry of corporate affairs.

- DOCUMENTS REQUIRED:

- PAN Card of the promoters

- Passport size photograph of both the promoters

- Aadhaar Card/ voter id of the promoters

- Bank Statement/Utility bill of both the promoters

- Rent agreement, if the registered place of business is a rented accommodation

- Electricity bill/ Water bill (registered place of business)

- No Objection Certificate

- TIME TAKEN: Online Company registration in Delhi takes around 7-10 working days rest depends on the approval by the ministry.

- PROFESSIONAL GUIDANCE: The incorporation process is not an easy task it requires a professional interface. From selecting the appropriate name in accordance with the Company (Incorporation) Rules, 2014 to the drafting of Memorandum of association and the incorporation documents, along with certification the forms professional guidance is required at every step of Company Incorporation.

To know more read: Private Limited Company

Frequently Asked Questions:

Q1. Can the Directors and shareholders be the same person?

Yes, the Shareholder can be the proposed directors of the Company.

Q2. What is the minimum capital requirement?

There is no such requirement of minimum capital but it is always advisable for private limited companies to have at least Rs.1 lakh as authorised capital.

Q3. Is there a need for professional certification?

Yes the Incorporation forms need to be certified by Chartered Accountant/ Company Secretary/ Cost Accountant or Advocate.

Q4. What is COB?

Every company incorporated after 01.11.2018 needs to file a form for Commencement of business.

Get Import Export Code Online on lowest cost.